Take stock of 2021 | Turn over the annual report card of China brand against the wind

[car home Information] The five-day losing streak ended, and the domestic auto market ended successfully in 2021. As an annual review and summary, car home continued to launch the "Inventory 2021" series, deeply disassembling the annual answers of major brands. The first issue of "Inventory 2021" focuses on China brand, and reviews with you the high-quality report card of China brand, whose market share reached 40% for the first time in 2021.

Note: The analysis of "Inventory 2021" series is all based on the insurance sales data of new cars of China Insurance Regulatory Commission.

Sales rose by 26.5%, with a market share of nearly 40%.

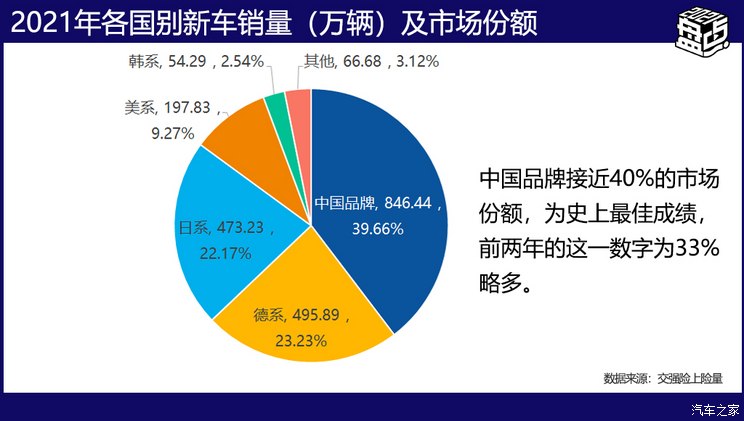

In 2021, the domestic sales of new cars reached 21.3436 million, ending the five-day losing streak and increasing by 6.33% year-on-year. Among them, the sales volume of China brand new cars reached 8,464,400. After four consecutive years of decline, the headwind turnover rose by 26.5% year-on-year, and the market share reached 39.66%, which was the best achievement in history. Previously, the market share of China brand cars exceeded 30% for the first time in 2016, and has been hovering around 33% ever since.

New energy to help overtake 40% is not a dream.

SUV is still the dominant category of China brand cars, with annual sales of 4,596,800 vehicles, accounting for 54.3% of China brand new cars, and accounting for 46.8% of the entire SUV market, more than twice that of Japanese SUVs and German SUVs; The annual sales volume of cars is 2,924,700, accounting for 29.1% of the whole car market, slightly lower than that of German cars and higher than that of Japanese cars.

Why did China brand cars turn over against the wind? The answer is the continuous expansion of new energy vehicle consumption.

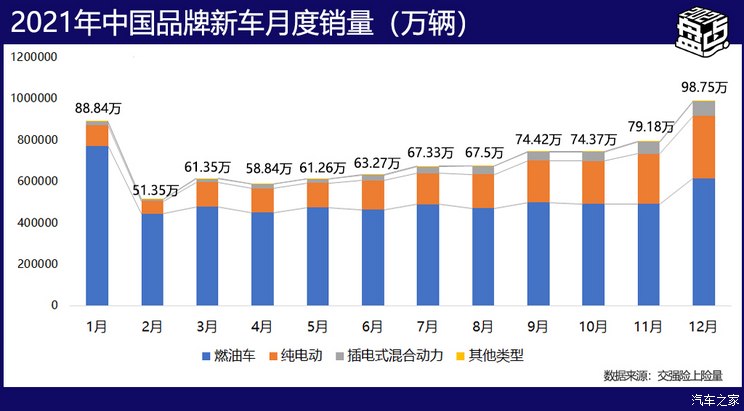

In 2021, the monthly sales volume of China brand fuel vehicles has been below 500,000, but new energy vehicles have continued to grow, especially pure electric vehicles. In 2021, China brand pure electric passenger cars sold 1.92 million vehicles, accounting for 80.3% of the total domestic pure electric vehicles; Plug-in hybrid vehicles sold 389,000 vehicles throughout the year, accounting for 71.1% of the corresponding market. China brand has been firmly established as the "home position" of domestic new energy vehicles.

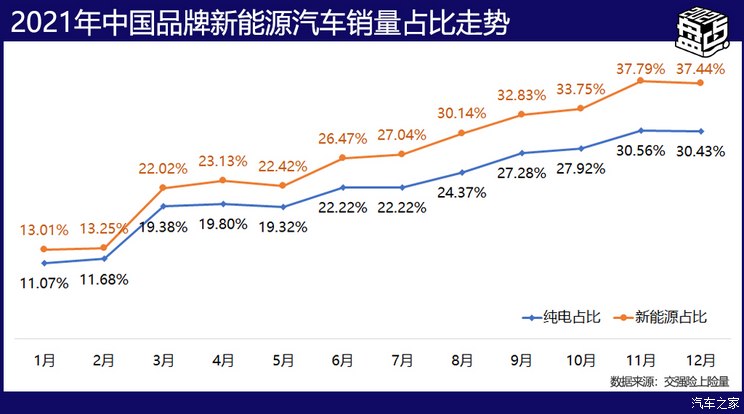

The continuous growth of new energy vehicle sales has changed the product pattern of China brand cars. In 2021, the sales of pure electric vehicles accounted for 22.7%, which broke through 20% in June, and then increased all the way, reaching more than 30% by the end of the year. In the whole year, the new energy utilization rate of China brand passenger cars reached 27.3%, which is a very high proportion. The activity of the market has inspired the optimism of forecasting institutions. The Association has set the sales volume of new energy passenger cars at 5.5 million in 2022, and doubled it on the basis of 2021.

Brand Top 20: two new forces enter the list WEY/ Pentium/BAIC exits.

Let’s look at the most watched brand rankings. We have listed the annual Top 20 list of China brands (Friendly reminder: The following list is worth your more attention.), the annual sales of these brands are basically above 100,000 vehicles.

According to the market scale, it is roughly divided into three echelons: the first echelon is five head brands with annual sales of more than 700,000 vehicles, followed by Geely Automobile, Changan, Wuling Automobile, Haval and BYD; The annual sales volume of the second echelon is more than 200,000 vehicles, and there are seven brands including Chery, Roewe, Guangzhou Automobile Chuanqi and Hongqi. The sales volume of the third echelon is 90,000-200,000 vehicles, including 8 brands such as Euler, Jetway, dongfeng fengshen and Guangzhou Automobile Ai ‘an.

Judging from the rising trend of various brands, BYD, Euler, Tucki, LI and Weilai all increased by more than 100% annually, among which Tucki increased by more than three times and LI nearly doubled. Regrettably, among the three new head forces, Weilai, who made the earliest effort and delivered the earliest mass production, did not make the list, ranking only one place in the 21st.

As a result of the annual brand qualifying competition, the three leading new car-making forces made great strides forward-Tucki ranked 18 th and advanced 123 places; LI ranked 19 th and advanced 10 places; Wei Lai ranked 21st, advanced 3 places, and Euler also advanced 10 places. If there is progress, there will be progress. In 2020, Qichen, Pentium, Jianghuai, WEY and BAIC, which ranked in the last five on the Top 20 list, fell out of the list in 2021, which is exactly what the waves behind the Yangtze River pushed forward.

Let’s open the transcripts of the top students below.

5 major head brands are detailed.

Geely Automobile: the only China brand with over one million yuan.

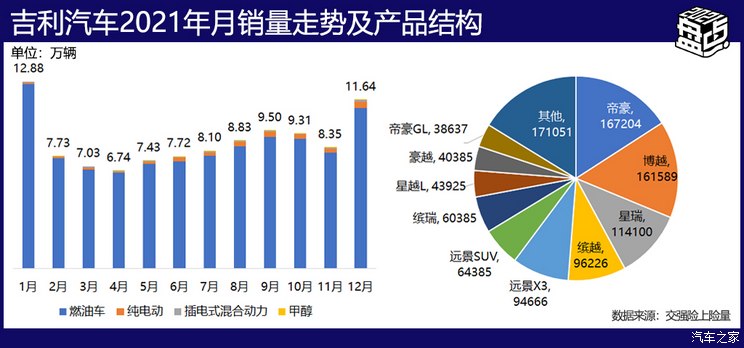

The annual sales volume of Geely Automobile is 1,052,600 vehicles, which is 4.55% higher than that of 2020. It still maintains the position of the first brand in China, and it is also the only China brand with annual sales volume exceeding one million, ranking fourth in the annual brand list. Although it is still far from Volkswagen and Liangtian, it has surpassed Nissan.

The best three cars sold by Geely are (|), Bo Yue and Xingrui, with annual sales of 167,000, 162,000 and 114,000 respectively, of which Emgrand’s annual growth rate reached 24.2%, Bo Yue decreased by 8.4%, and the monthly sales of Xingrui listed in October 2020 has exceeded 10,000.

Emgrand has been listed for many years, and derived Emgrand L, Emgrand S, Emgrand GL (discontinued) and corresponding new energy vehicles. The sales volume of Emgrand in 2021 reached 278,500, and the monthly sales volume basically remained at 20,000+.

In terms of power type, Geely brand is still dominated by fuel vehicles, with annual sales of 1,016,200 vehicles, while the sales of pure electric vehicles are only 26,500 vehicles, with less than 10,000 vehicles mixed, and 838 methanol vehicles.

If we look at the whole Geely Group, the strategies of its brands are different. For example, Lectra focuses on the young market, and the main models are basically "fuel vehicles+plug-in models" partners. Extreme Krypton focuses on the electric market. As of December, the cumulative sales volume of ZEEKR 001, the first medium and large pure electric car of Extreme Krypton, was 5,737. Whether Krypton can make Geely Group open a new world in the electric market and help Geely continue to attack Honda remains to be tested.

Chang ‘an: Is New Energy Left Behind?

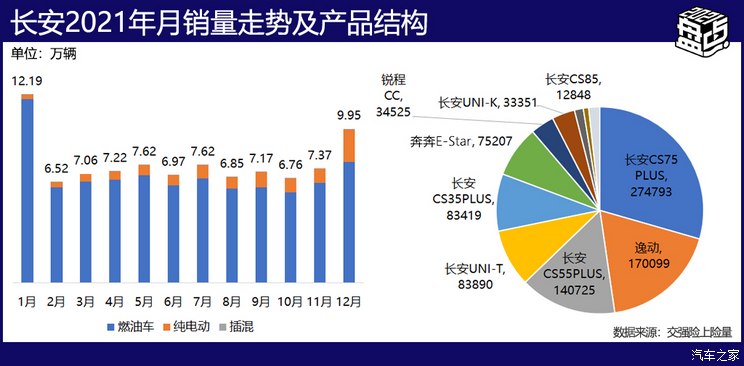

Changan’s annual sales volume was 932,800 vehicles, up 14.19% year-on-year. China brand echelon ranked second, ranking sixth in the overall list, with a gap of less than 110,000 vehicles compared with Nissan.

Changan’s Hua Dan is Changan CS75 PLUS, with annual sales of 275,000 vehicles, which is basically the same as that of the previous year. It is the runner-up in compact SUV sales and the most taboo product of Haval H6, with the current monthly sales of 23,000+.

Yidong, the China brand compact car with the highest sales volume, sold more than 170,000 cars in the whole year, slightly more than Emgrand; Another compact SUV, Changan CS55PLUS, is its third-selling model, with annual sales of 141,000 vehicles.

UNI series sold a total of 117,000 vehicles in 2021, including 84,000 vehicles sold by UNI-T and 33,000 vehicles sold by Uni-K.. Changan UNI-V has started pre-sale and will be listed in the first quarter of this year.

In terms of product power types, Changan’s fuel vehicles sold 837,100 vehicles and pure electric vehicles sold 95,500 vehicles throughout the year, basically supported by a mini-car of Benben -E-Star. At present, Changan has not launched an independent new energy source, but at the end of 2021, it joined hands with Huawei, Contemporary Amperex Technology Co., Limited and Weilai to launch Aouita, a brand of "high-end intelligent electric vehicle".

Wuling: the low-priced car king refuses to accept it.

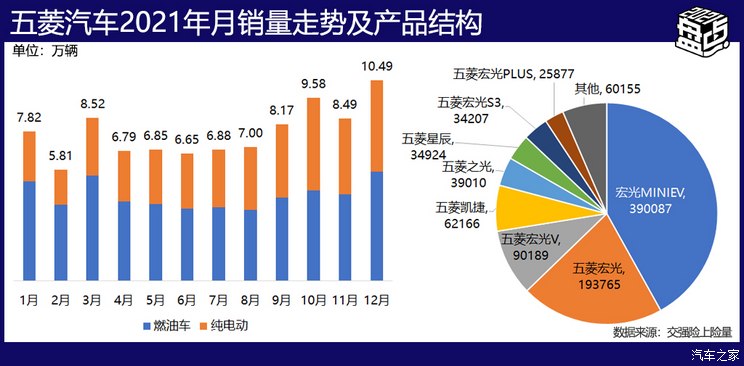

Wuling Automobile sold 930,400 vehicles annually, with a strong increase of 58.6%, ranking third in the brand list of China and seventh in the overall list. Hongguang MINIEV, like howard the duck, is not only the "hero" of Wuling, but also the annual sales king of China brand new cars, which evokes the "second spring" of the domestic mini-car market.

Wuling is definitely a brand that honestly carries out the low-price strategy. The annual sales of 930,400 vehicles are mainly supported by these cars. You can see it at a glance-

Hongguang MINIEV, with an annual sales volume of over 390,000 vehicles, surged to 46,000 vehicles in December, which is definitely half of Wuling brand; The second largest is Wuling Hongguang, with an annual sales of 194,000 vehicles; The third is Wuling Hongguang V, with an annual sales of more than 90,000 vehicles, and the compact MPV Wuling Capgemini has an annual sales of 62,200 vehicles. Three cars below 50,000 yuan account for 3/4 of its annual sales.

Attracted by the explosion of Hongguang MINIEV, the domestic mini pure electric market also broke out again in 2021, with more than 40 models on sale, but there is no difference between products and there is obvious convergence. Judging from the market performance, Hongguang MINIEV "has been imitated, but has not been surpassed yet", and half of the mini-car market has been eaten by Hongguang MINIEV. Except Hongguang MINIEV, no China brand car has a monthly sales volume of more than 40,000.

Haval: Really don’t consider the new energy SUV?

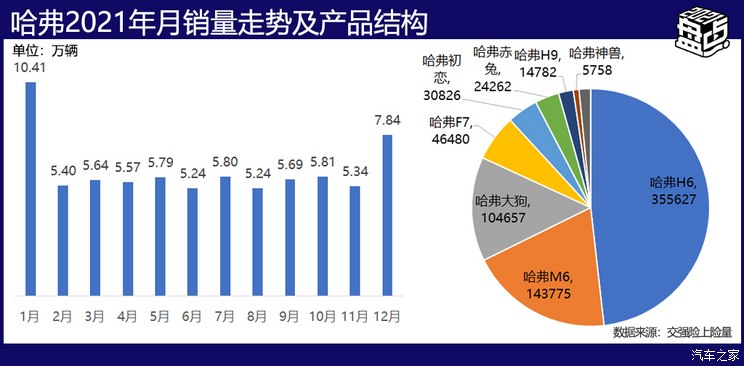

In 2021, Haval achieved a sales volume of 738,000 vehicles, a slight increase of 2.34% over the previous year, lagging behind the overall automobile market, and dropped one place on the list, from the third place in the previous year to the fourth place. Haval is also the lowest annual growth rate among China brands. Considering that Harvard introduced a series of new cars named after animals in 2021, this growth rate is even more "gold content" insufficient.

Haval H6 is still the main force, with annual sales of 356,000 vehicles, an increase of 3.4%, accounting for almost half of the brand’s annual sales; Haval M6 sold 144,000 vehicles, down 6.4%. The annual sales volume of Haval Big Dog also exceeded 100,000 vehicles, making it one of the "three-legged" brands supporting Haval, and its monthly sales volume has exceeded 10,000, which is the earliest debut in Haval’s "Zoo Series" and the best one currently sold.

Haval Beast, which shoulders the heavy responsibility of brand promotion, quality promotion and tide wisdom promotion, and tries to break the existing cognition of H6, is the least H6-like model of Haval. It sold 5,662 vehicles in December shortly after its launch.

In fact, Haval’s main models can basically be regarded as all kinds of changes or derivatives of the new and old H6, which makes its products have various changes in appearance, and the interior/entertainment/intelligence is also extremely differentiated, but in the end, the feedback to the consumer cognition level has little differentiation. After desperately "having children", the Great Wall needs to think about how to "raise children".

As the main brand of Great Wall Motor, Haval has not taken any action in the field of new energy. Great Wall has also laid out pure electric vehicles in Euler and Mechanon, and laid out hybrid vehicles in WEY. Euler’s annual performance has also submitted an excellent report card to Great Wall. In the face of the lack of growth of the Harvard brand, does the Great Wall really not consider letting new energy sources "save"?

BYD: DM-i was a hit.

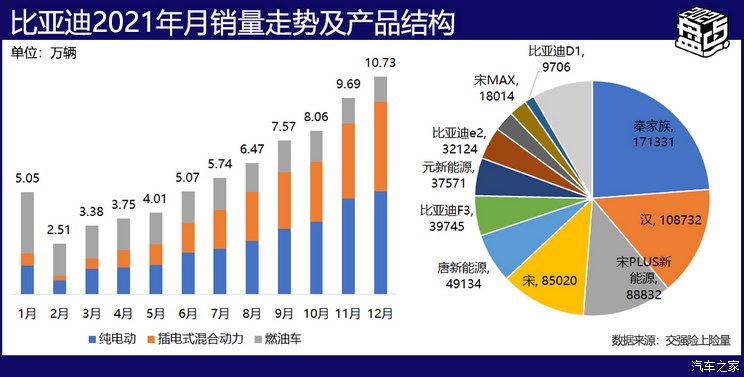

Finally came to BYD. BYD recorded a sales volume of 720,300 vehicles in 2021, with 17,000 vehicles just behind Haval, ranking fifth in the China brand list.

From the perspective of monthly sales, BYD is the only brand that continues to climb. There is no trough in a year, that is, it attacks all the way. BYD is also a brand of plug-in hybrid and pure electric. In the whole year, pure electric vehicles sold 297,000 vehicles, plug-in hybrid vehicles sold 229,000 vehicles, and fuel vehicles were a minority, with only 194,000 vehicles.

BYD achieved a record in 2021 with the assistance of blade batteries and DM-i models. The highest sales volume of bicycles is Han, with the annual sales volume of 109,000 vehicles, ranking fourth in the annual list of medium and large cars, which is the first time that China brand cars have achieved the best results in this market segment. The annual sales gap between Han and Mercedes-Benz E-Class is 44,000 vehicles. Do you think this gap will narrow in 2022? Expand? Or fill it in?

Let’s set a straight face here.At present, many articles say that the annual sales volume of Qin PLUS DM-i exceeds 190,000 vehicles. In fact, this figure is the annual wholesale sales volume of the entire Qin family, including oil trucks. It is not the achievement of Qin PLUS DM-i, after all, it has only been on the market for 10 months. According to the traffic insurance data, in 2021, the sales volume of the entire Qin family was 171,331.

Unfortunately, as of press time, we have not been able to separate the specific sales volume of Qin PLUS DM-i, but based on the monthly sales volume, the annual sales volume should be above 80,000, and the highest monthly sales volume is close to 15,000. Therefore, the new energy sources of Han, Qin PLUS DM-i and Song PLUS should be the top three cars of BYD.

Although BYD ranked 5th in the whole year, its insurance sales in November ranked first in China brand, and ranked second in December. With the heavy volume of a number of new cars, especially DM-i series models, BYD’s ranking will definitely go up again next year. Anyway, Harvard is afraid it can’t stand it.

Pursuing victory and inciting the new market of high-end intelligent electric vehicles

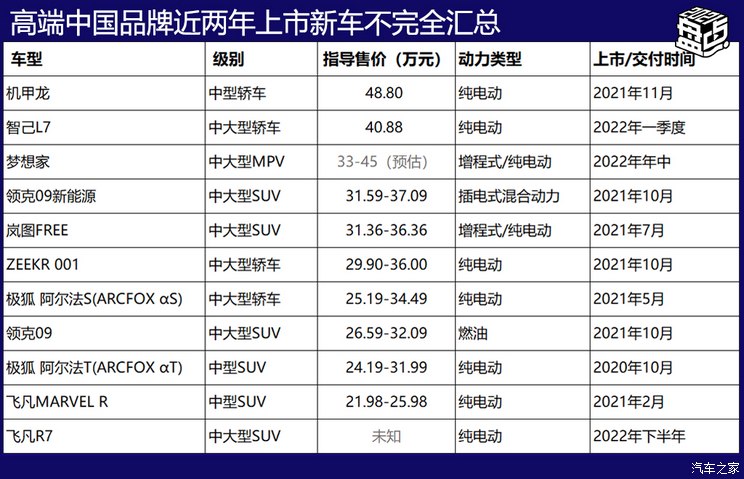

The record of China brand in 2021, especially the rapid development of new energy vehicles, has once again sounded the drum of brand promotion. This year, China car companies seem to have found the same way: to launch a new brand with a golden spoon, which is independent from the mother’s fetus, so as to reinvent itself and create a brand-new high-end image.

Geely introduced Krypton, Dongfeng introduced Lantu, and Zhiji of SAIC, Salon of Great Wall and Aouita of Chang ‘an all came out in 2021, and set up a new brand, reinventing themselves and rushing to the high end-this is a highly consistent tactic of many car companies at present.

Most of the technical routes of these high-end new brands focus on the electric and intelligent next-generation cars, and in product strategy, they focus on high-end cars with a price of 300 thousand to 400 thousand. However, the high-end password in the electrification era and the fuel era are no longer in a thinking paradigm. So what’s the secret of winning at this new track? This is the next major proposition of China brand.

Editor’s comment:

China brands have always hated low-grade products with a market share of less than 30% and the occupation of fourth-and fifth-tier cities. However, the situation changed in 2021. Although the term "overtaking in corners" is no longer in the mainstream discourse system, the performance of China brand in 2021 seems to verify this former vision. This year, China brand made collective efforts on the new energy track, and began to seek high-end and advanced again. After the headwind, how can it continue to be born in the sun? In 2022, the answer will be given.

Then, we might as well make two guesses here: First, will BYD surpass Haval? Second, it has surpassed Han in lexus ES. Will it surpass Mercedes-Benz E-Class in the future? (Text/car home Wang Jingbo)